35+ Utah Paycheck Calculator

Web Enter your employment income into the paycheck calculator above to estimate how taxes in Utah USA may affect your finances. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4.

Esmart Paycheck Calculator Free Payroll Tax Calculator 2022

Web Free Utah Payroll Tax Calculator and UT Tax Rates.

. Web Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. Web You are able to use our Utah State Tax Calculator to calculate your total tax costs in the tax year 202223. Utah Payroll Tax Rates.

Use Gustos hourly paycheck calculator to determine withholdings and calculate take-home. Web The standard deduction dollar amount is 12950 for single households and 25900 for married couples filing jointly for the tax year 2022. For example if an.

Web How to calculate annual income. Total annual income Income tax liability Payroll tax liability Pre-tax deductions Post-tax deductions Withholdings Your paycheck. According to the Small.

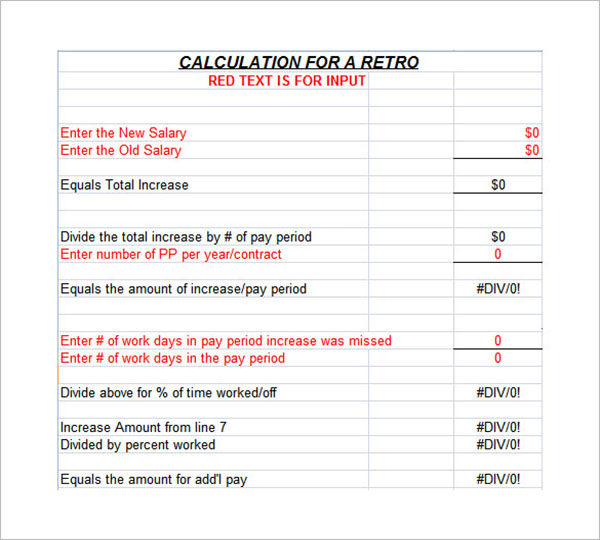

In 2015 FUTA tax percentage is 06 percent of the first 7000 of wages per year. To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year. Web Paycheck Calculator This free easy to use payroll calculator will calculate your take home pay.

Well do the math for youall you need. Web Utah Hourly Paycheck and Payroll Calculator Need help calculating paychecks. Our calculator has recently been updated to include both the latest.

Your average tax rate is 1198 and your marginal tax. Web By using Netchexs Utah paycheck calculator discover in just a few steps what your anticipated paycheck will look like. Utah Paycheck Calculator Frequently Asked.

Web Utah Salary Paycheck Calculator Change state Calculate your Utah net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state. Just enter the wages tax withholdings and other information. Taxpayers can choose either itemized.

Supports hourly salary income and multiple pay frequencies. Web Use ADPs Utah Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees. Web Utah Income Tax Calculator 2021 If you make 70000 a year living in the region of Utah USA you will be taxed 11852.

Web The formula is. Youll then get your estimated take home pay an. Web Use Gustos salary paycheck calculator to determine withholdings and calculate take-home pay for your salaried employees in Utah.

Figure out your filing status work out your adjusted gross. Web Employers pay FUTA tax based on employee wages or salaries. Web Utah Hourly Paycheck Calculator.

Web Calculating your Utah state income tax is similar to the steps we listed on our Federal paycheck calculator.

Hourly Paycheck Calculator Nevada State Bank

What Is The Monthly Expenses In Us For A Family Of 4 People 2 Adults And 2 Kids Quora

New Tax Law Take Home Pay Calculator For 75 000 Salary

Utah Paycheck Calculator Adp

Utah National Parks Road Trip Of A Lifetime Photos Itinerary

What Is The Income Tax On Gains On Stocks Quora

7 Weekly Paycheck Calculator Doc Excel Pdf

Utah Paycheck Calculator Adp

Csg Reviews Glassdoor

How Much Does Safetyculture Pay In 2022 56 Salaries Glassdoor

12 Salary Paycheck Calculator Templates Free Pdf Doc Excel Formats

Free 12 Paycheck Calculator Samples Templates In Excel Pdf

Parc West Apartments 461 West 13490 South Draper Ut Rentcafe

Free Payroll Tax Paycheck Calculator Youtube

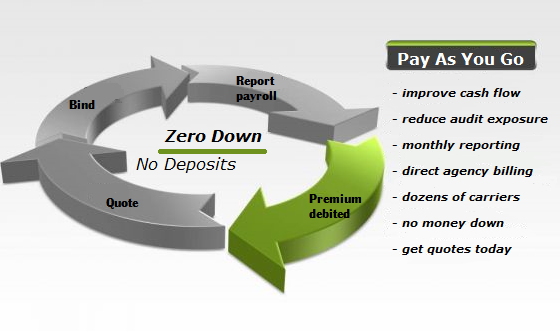

Workers Compensation Insurance Payment Options

Utah National Parks Road Trip Of A Lifetime Photos Itinerary

Tri County Edition Genesee Valley Penny Saver 11 12 2021 By Genesee Valley Publications Issuu